29 Mar Just how do taxation on the lotteries, gambling enterprises, wagering, or other sort of county-approved playing performs?

Remarkably, merely 27 of your own states where wagering are courtroom enable it to be one another merchandising an internet-based gaming. One other several allow both merchandising or on line gambling, yet not each other. The total guide traces in which as well as in just what ability sports betting try judge in the united states.

Reporting Gambling Profits

By law, sports gamblers in the united states have to pay taxation to their winnings, whatever the amount. Web based poker competition profits away from $5,000 or more score a https://centrodebelezabotafogo.com.br good W2-Grams, as the perform online sportsbook bets one earn more than 300 in order to 1, along with online betting profits during the period of the new year you to exceed $600. Legal web based casinos in the usa will follow such exact same earliest principles. When you victory a huge sum of money plus the casino items you an excellent W-2G form, think of it instantly publish a copy to the Internal revenue service. For many who don’t statement those individuals winnings, you’ll end up being informed by the Internal revenue service that your income tax come back do maybe not match its facts.

???? Us Playing Taxation in a nutshell

Sure, all-licensed casinos and you can sportsbooks need report to the newest Irs and you will deposit the new W-2G setting occupied by the casino player otherwise winner. Rigged gambling enterprises functioning away from to another country will most likely not worry about the newest Irs and you should avoid them. Note the application of fulltime, with regularity, and you will production of income for a living.

In addition to spending taxation as required, be sure in order to report him or her sufficiently. Accurate taxation revealing utilizes just how prepared you keep their details. If you they proper, you can also take advantage of possible write-offs to possess losings sustained on your sports betting function.

The newest American Playing Organization (AGA), the fresh tribal betting globe, or other stakeholders support so it alter. So far, there were zero voice opposition for the recommended alter. On may 5, 2024, they reintroduced the newest laws and regulations to help you update the fresh Position Act and you can amend the brand new fifty-year-dated, dated revealing threshold. Gambling providers also are required to complete setting 1042-S to help you declaration playing profits paid in order to low-resident aliens and you will foreign firms. One to restriction for the playing money is the fact plenty of playing options can be cannibalize a good state’s choices.

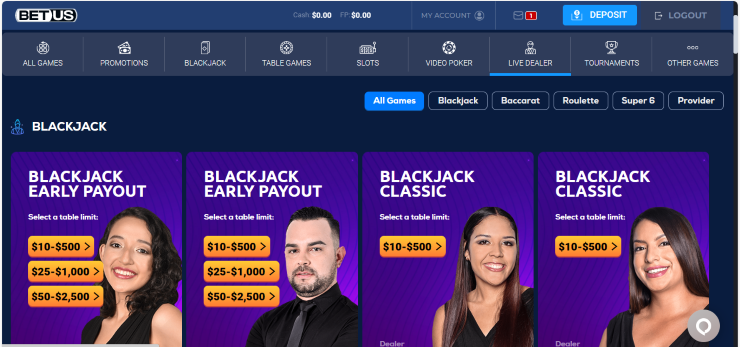

Common gambling enterprises

In america, the interior Revenue Provider (IRS) snacks gaming winnings while the nonexempt income, that will provides significant consequences otherwise properly stated. Taxes to your gaming profits is actually payable whether or not you bet on the web otherwise which have a retail sportsbook. While the costs and you may laws and regulations to own federal tax will be the exact same, there is variations in this condition taxation cost to own one another different wagering. Betting earnings is actually nonexempt like most other income you receive throughout the the entire year. Whether or not you receive a great W-2G on the local casino, it’s your decision to statement “earned” profits on your private taxation setting.

- To possess tax intentions, specific says require gambling winners to claim the newest betting winnings inside the official in which they certainly were claimed.

- Basic, for individuals who don’t itemize the deductions (since you wear’t have enough deductions to itemize) you lose out on the playing loss.

- For many who enjoy real cash keno, you acquired’t end up being awarded a great W-2G function if you do not generate $step one,five hundred or more within the keno profits for every gamble.

- You may also contribute a number of the money so you can foundation and you will subtract they otherwise purchase it inside the a trust and this cuts back your instant taxes.

- The duty is by using you and perhaps not the brand new casino, even though, anytime an agent doesn’t make you a good W-2G setting, you still have in order to statement your own winnings.

But not, let’s assume no tax is actually withheld and also you never receive a great function. In this instance, you will be responsible for processing and you will revealing all your gambling income from the state and federal level. The procedure of revealing and you may withholding also can disagree ranging from retail an internet-based playing organizations in numerous claims.

The newest Act applies to pros you get yourself number (senior years or impairment professionals) and spouse’s or enduring mate’s pros for the someone’s listing. Exactly what step you need to relies on your role and about what sort of benefits you are entitled to. Someone whoever month-to-month benefit is actually modified, otherwise who will score a good retroactive fee, will get a great mailed observe out of Public Security explaining the bonus transform or retroactive fee.

Sorry, the comment form is closed at this time.